To think like an owner, property managers must regularly “listen” to their properties. Proactive inspections help identify problems before they escalate, ensuring long-term value and tenant satisfaction.

To think with an owner mindset, property managers must regularly “listen” to their properties. Proactive inspections help identify problems before they escalate, ensuring long-term value and tenant satisfaction.

For instance, we took over the management of a property that had been suffering from years of neglect. We quickly noticed structural issues—cracked walls and a leaking pool—that previous managers had overlooked. By acting with an Ownership Mindset, we addressed these problems head-on, turning what could have been a deteriorating asset into a thriving one.

Key Action: Conduct regular inspections to catch small issues before they become costly repairs. Acting like an owner means investing in long-term solutions, not just quick fixes.

Why Coastline Equity Inspects Every Property Regular

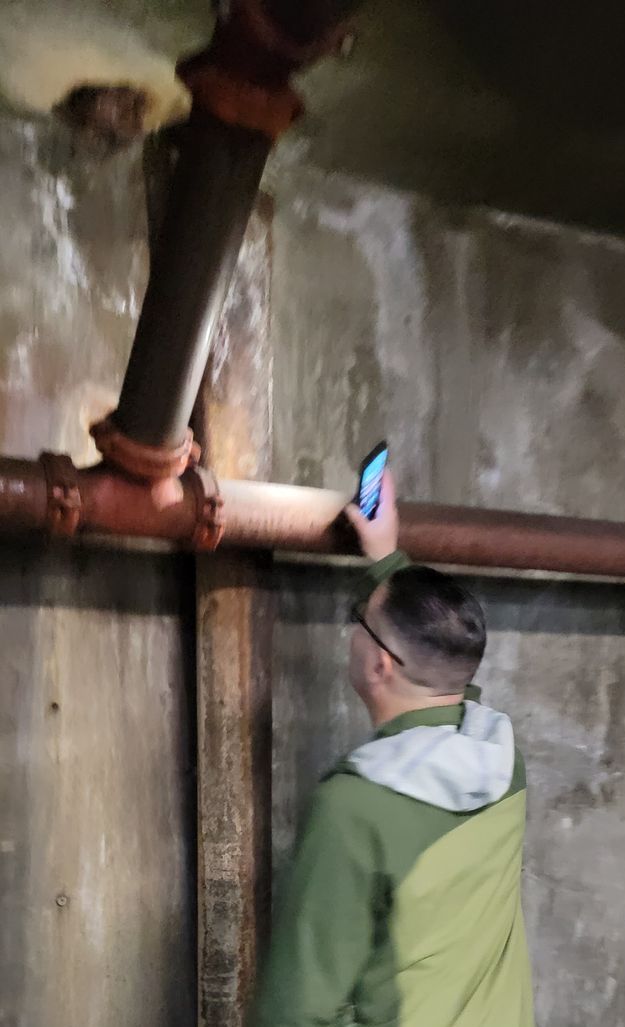

Regular property inspections are key to maintaining the quality and safety of our properties. Proactive property inspections is one of the main ways that we act with an owner mindset. Here’s why we prioritize this practice:

Ensuring Habitability and Safety: Regular inspections help us identify issues that could affect the habitability and safety of our properties. From checking smoke detectors to ensuring the structural integrity of buildings, our goal is to provide a secure living environment for our tenants.

Proactive Maintenance: Inspections allow us to catch maintenance issues early before they become costly problems. This proactive approach helps us manage repairs more efficiently, reducing the likelihood of emergency situations that can be disruptive and expensive.

Enhancing Tenant Satisfaction and Retention: A well-maintained property leads to happy tenants. Regular inspections show our tenants that we care about their well-being and are committed to providing them with a comfortable living or working space.

This, in turn, fosters tenant loyalty and reduces turnover. structural issues—cracked walls and a leaking pool—that previous managers had overlooked. By acting with an Ownership Mindset, we addressed these problems head-on, turning what could have been a deteriorating asset into a thriving one.