Rent Increases California 2025

Understanding New Regulations and Trends

In California, understanding rent increases is crucial for both tenants and landlords.

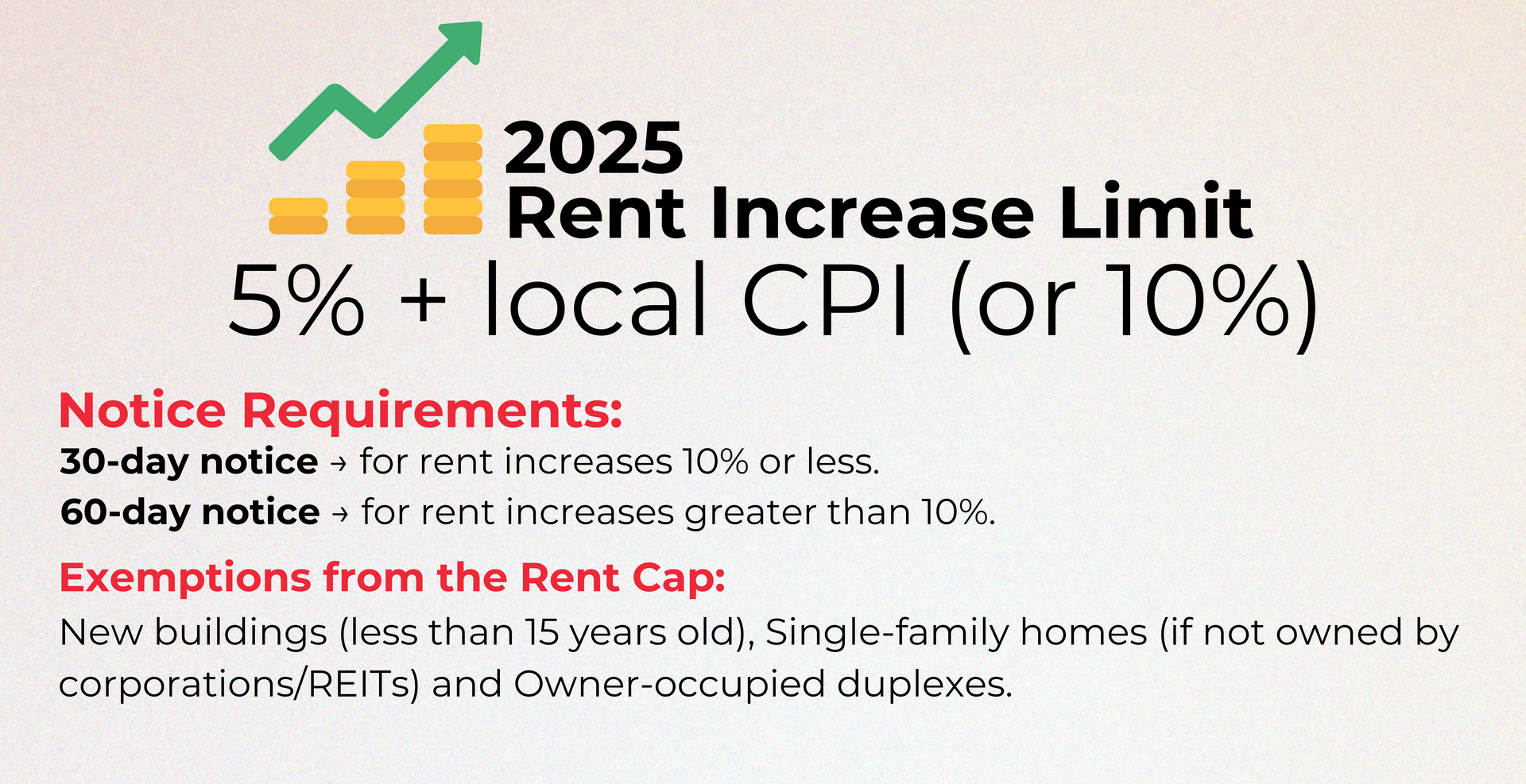

Starting in 2025, the maximum allowable rent increase will be capped at 5% plus the local Consumer Price Index (CPI), or 10%, whichever is lower. This change is part of ongoing efforts to provide stability in housing costs amid rising inflation and housing demands.

As you navigate the rental landscape in California, it's important to know your rights and responsibilities.

The Tenant Protection Act governs these limits and applies to many rental properties statewide, ensuring that you are protected from sudden or excessive increases.

Whether you are a landlord planning your rental adjustments or a tenant bemused by potential hikes, staying informed is your best strategy.

With evolving regulations, it’s beneficial to familiarize yourself with the specifics surrounding rent control and the factors that can affect your rental situation. This knowledge empowers you to make informed decisions and advocate for your interests in the rental market.

Key Takeaways

- Rent increases in 2025 will be capped based on a specific formula.

- Knowledge of the Tenant Protection Act helps protect your rights.

- Understanding local regulations can impact your rental experience.

Overview of Rent Increase Regulations in California

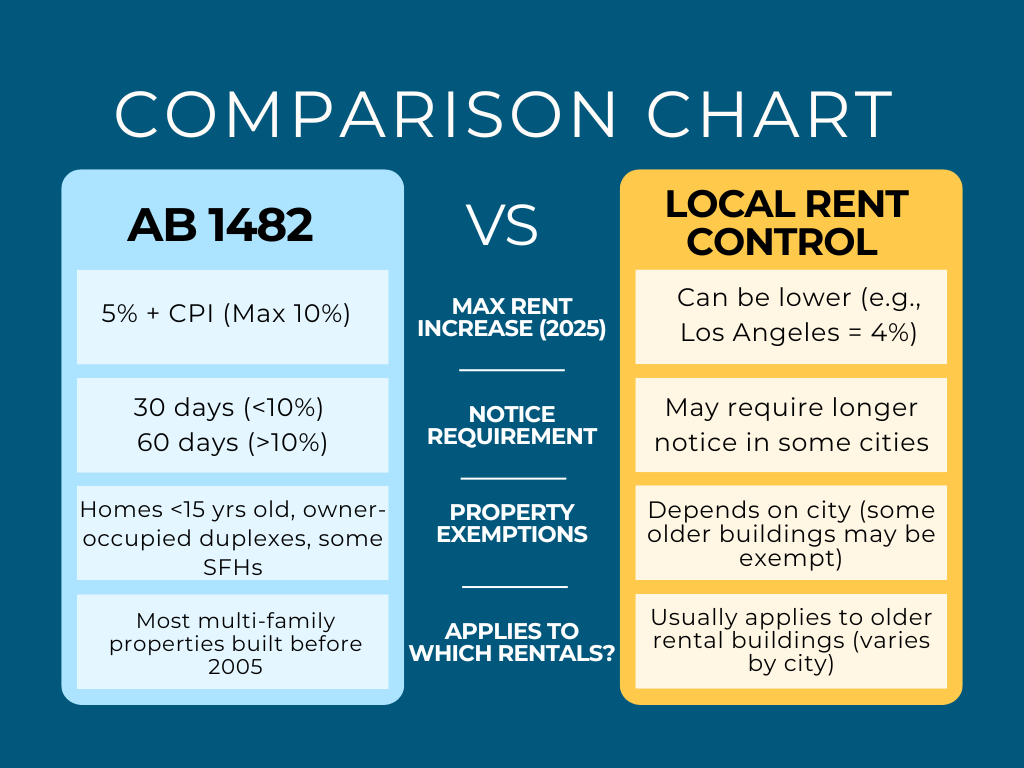

In California, rent increases are regulated to protect tenants. The Tenant Protection Act of 2019, also known as AB 1482, sets clear rules for how much rent can be raised.

Under this law, landlords can raise rent by a maximum of 5% plus the local Consumer Price Index (CPI) change. This increase is capped at 10% in any given year.

Most rental properties built before January 1, 2005 are affected by these rules. This includes single-family homes and apartments, unless the landlord is an owner-occupant living in the property.

Key Points:

- AB 1482 applies statewide, meaning all areas follow the same rules.

- Notice Requirements: Landlords must give 30 days' notice for rent increases under 10%. For increases over that amount, a 60-day notice is required.

- Exemptions: Some properties are exempt from these regulations, such as newly built homes and affordable housing.

Understanding these regulations helps you know your rights as a tenant.

Stay informed to ensure your landlord follows the law and respects your rental agreement.

Understanding Rent Control and Rent Stabilization

Rent control and rent stabilization are key policies that impact tenants in California. These measures are designed to keep housing affordable and protect renters from significant rent increases. Understanding how they work can help you navigate the rental market effectively.

Differences Between Rent Control and Rent Stabilization

Rent control typically sets strict limits on the amount landlords can charge for rent. It may also restrict the ability to increase rent at all.

In contrast, rent stabilization allows for limited increases, such as a percentage tied to the local Consumer Price Index. This means rent can go up, but only within specific bounds.

In California, local rent control ordinances vary widely.

For example, Los Angeles has its own rules that restrict annual increases. The city caps rent increases at a certain percentage, protecting tenants from steep hikes.

San Francisco also has stringent rent control laws, aiming to keep housing affordable in a high-demand area. In Oakland, you also find rent stabilization measures in place, reflecting the city’s commitment to tenant protection.

Cities with Rent Stabilization Ordinances

Various cities in California have adopted their own rent stabilization ordinances. These laws help limit rent increases and provide essential protections for renters. Cities like Los Angeles, San Francisco, and Oakland are prominent examples.

Los Angeles enforces its Rent Stabilization Ordinance (RSO), which controls how much landlords can raise rents on covered units. The RSO is aimed at keeping housing accessible in a bustling city.

San Francisco has one of the most well-known rent control laws, enacted in 1979, focusing on stabilizing the market amid rising costs. In Oakland, the Rent Adjustment Program limits increases and provides tenants with rights against unjust evictions.

Staying informed about these ordinances can help you ensure your rights as a tenant are upheld in California’s competitive rental landscape.

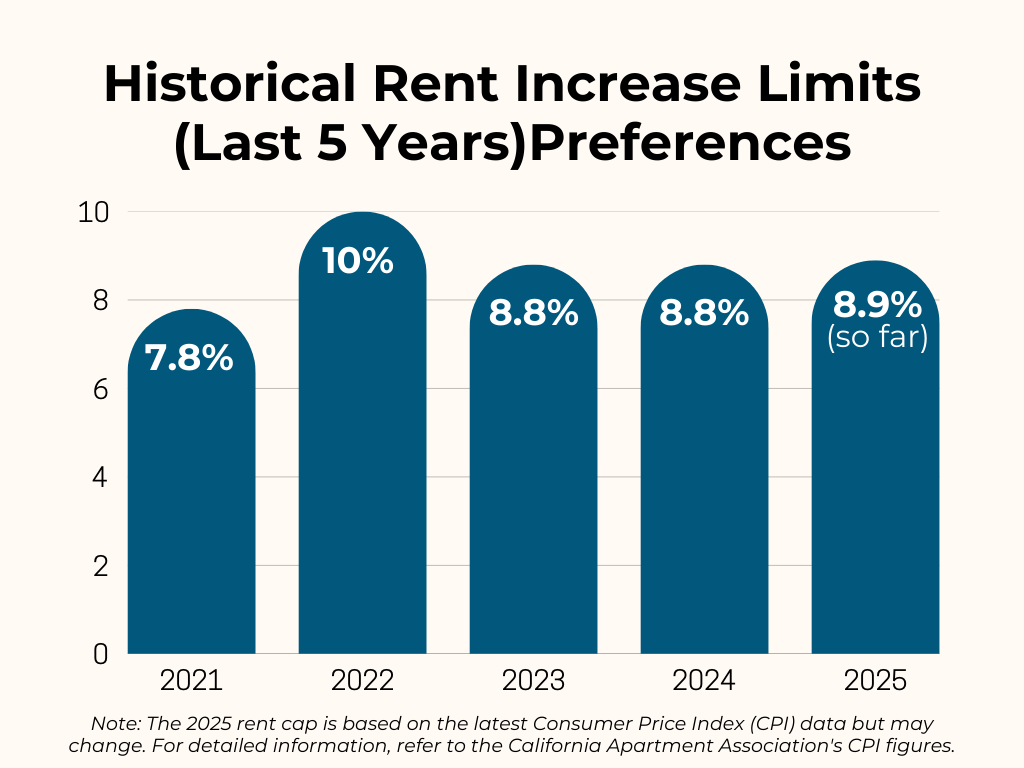

2025 Updates to Rent Increase Limits and Calculations

In 2025, new rules impact how much rent can increase in California. Understanding these updates helps you stay informed about your rights as a tenant or responsibilities as a landlord.

Below are key areas, including allowable increases and how the Consumer Price Index (CPI) plays a role.

Annual Allowable Rent Increase

Starting January 1, 2025, the annual allowable rent increase in Los Angeles County will be linked to changes in the CPI. The increase is capped at 60% of the CPI’s percentage change over the previous year. This adjustment ensures that rent increases reflect economic trends while protecting tenants from sudden hikes.

For properties covered by statewide laws, the Tenant Protection Act limits increases to 5% plus the CPI change, but not exceeding 10%. This balance provides predictability for both tenants and landlords.

Consumer Price Index (CPI) Adjustments

The CPI is crucial in determining rent increase limits. It measures changes in the price level of a basket of consumer goods and services, reflecting inflation. In California, the CPI affects how much rent can increase each year.

For each area, a regional CPI calculator can help you find the specific CPI change for your location.

It is essential to track these figures, as they directly influence allowable rent increases.

If the CPI shows a significant rise, the allowable rent increase may be higher. You should check the most recent CPI data regularly to stay updated.

Maximum Allowable Rent Increase

In the context of new regulations, the maximum allowable rent increase is designed to protect tenants from severe financial stress. Depending on your property’s age and location, the cap can vary.

For instance, under AB 1482, the maximum increase is 5% plus the CPI, not exceeding 10% in any twelve-month period. This means if the CPI is low, your increase may only be 5%.

It's important to note that if utilities like gas and electricity are included in your rent, an additional 1% may apply to the increase. Always verify the specific rules that apply to your rental situation or property.

Tenant and Landlord Obligations

Understanding your obligations as a tenant or landlord is crucial. Each party has specific rights and responsibilities that help maintain a fair rental relationship.

Landlord Requirements for Rent Increase Notices

As a landlord, you must follow specific rules when increasing rent. You must provide written notice to your tenant about the rent increase. The notice period depends on the amount of the increase.

- If the rent increase is 10% or less, you must give at least 30 days' notice.

- For increases of more than 10%, a notice of 90 days is required.

Your notice should clearly state the new rent amount and the date it takes effect. This ensures that tenants understand their financial obligations and can prepare accordingly.

Additionally, you cannot impose a rent increase more than once within a 12-month period under the California Tenant Protection Act.

Tenant Rights and Protections

You have important rights as a tenant regarding rent increases. Under California law, there are limits on how much your landlord can increase your rent.

- Rent can be increased by 5% plus the local Consumer Price Index (CPI), with a maximum increase of 10% in a given year.

If you believe that your landlord has violated these rules, it's essential to act quickly. You can file a complaint or seek legal advice.

You are also protected from eviction without legal cause. If your landlord tries to evict you after an illegal rent increase, you can challenge this action in court.

Knowing your rights helps you to ensure fair treatment in your rental arrangement.

Frequently Asked Questions

This section addresses common questions about rent increases in California for 2025. You will find specific details regarding legal requirements and limits that landlords must follow.

How often can landlords legally increase rent in California?

Landlords can increase rent once every 12 months under the California Tenant Protection Act. This law applies to most residential properties, limiting how frequently you can expect changes to your rent.

What is the maximum permissible rent increase in California for the year 2025?

In 2025, the maximum rent increase is set at "5% plus the percentage change in the cost of living," with a cap at 10%. This limit helps protect tenants from excessive rent hikes.

Are landlords required to provide a 30-day notice for rent increases in California?

Yes, landlords must provide a written notice of 30 days for rent increases that are 10% or less. If the increase exceeds 10%, a 90-day notice is required.

How does one calculate rent increases in California?

To calculate rent increases, first determine the current rent amount. Then, apply the allowable increase based on the local rent control laws and the consumer price index to find the new rent.

Always check the latest regulations for accurate figures.

What are the new renter laws introduced in California in 2024?

New laws for 2024 include updated reporting requirements for rental payment histories and additional protections against certain eviction procedures. These changes aim to strengthen tenant rights.

Is there a cap on the percentage a landlord can raise rent in California?

Yes, there is a cap. Rent increases are capped at 5% plus the change in the cost of living, with a total maximum of 10% in a year.

This policy ensures fair and predictable rent adjustments.

Let's elevate the industry together—share this blog with fellow investors.

More about Coastline Equity

Property Management Services

Learn More

Learn MoreOur team will handle all your property needs, offering specialized services such as in-depth inspections, liability management, staff recruitment and training, and round-the-clock maintenance—expert support tailored to the unique requirements of your real estate assets.

About Us

Learn More

Learn MoreOur dedicated team transforms property management challenges into opportunities. From tenant management to streamlined rent collection and proactive maintenance.

Property Management Excellence

Learn More

Learn MoreAs a contributing author for Forbes, Anthony A. Luna brings a wealth of expertise and knowledge in the property management industry, real estate sector, and entrepreneurship, providing insights and thought-provoking analysis on a range of topics including property management, industry innovation, and leadership.

Anthony has established himself as a leading voice in the business community. Through his contributions to Forbes, Anthony is set to publish his first book, "Property Management Excellence" in April 2025 with Forbes Books.

Insights

Learn More

Learn MoreLearn more about Coastline Equity's property management practices & processes and how we support our clients with education and a growth mindset.

Coastline Equity Property Management is your partner as you continue to learn and grow.

News & Updates

Property Management Made Easy

Los Angeles

1411 W. 190th St.,

Suite 225

Los Angeles, CA 90248

Temecula

41743 Enterprise Circle N.,

Suite 207

Temecula, CA 92590