Protecting Your Property and Ensuring Quick Resolution

Water leaks are one of the most common and potentially damaging issues that can affect any property. A burst pipe, a broken water heater, or hidden water leaks can cause big problems.

These issues can get worse fast. If not fixed quickly, they can lead to serious property damage and

expensive repairs. For property owners, especially those managing a rental property, understanding how water leaks are handled by a property manager is crucial for maintaining the structural integrity of the building and ensuring tenant satisfaction.

In this blog post, we'll explore how property managers like Coastline Equity handle water leaks, the importance of

preventative measures, and what you, as a property owner, should know about safeguarding your investment against different types of water damage.

Recognizing the Signs of Water Leaks

One of the first responsibilities of a property manager is to quickly identify the signs of water damage in a building.

Common indicators of a leak include:

- Visible water spots on walls or ceilings

- Damp or musty odors

- Soft or buckling drywall

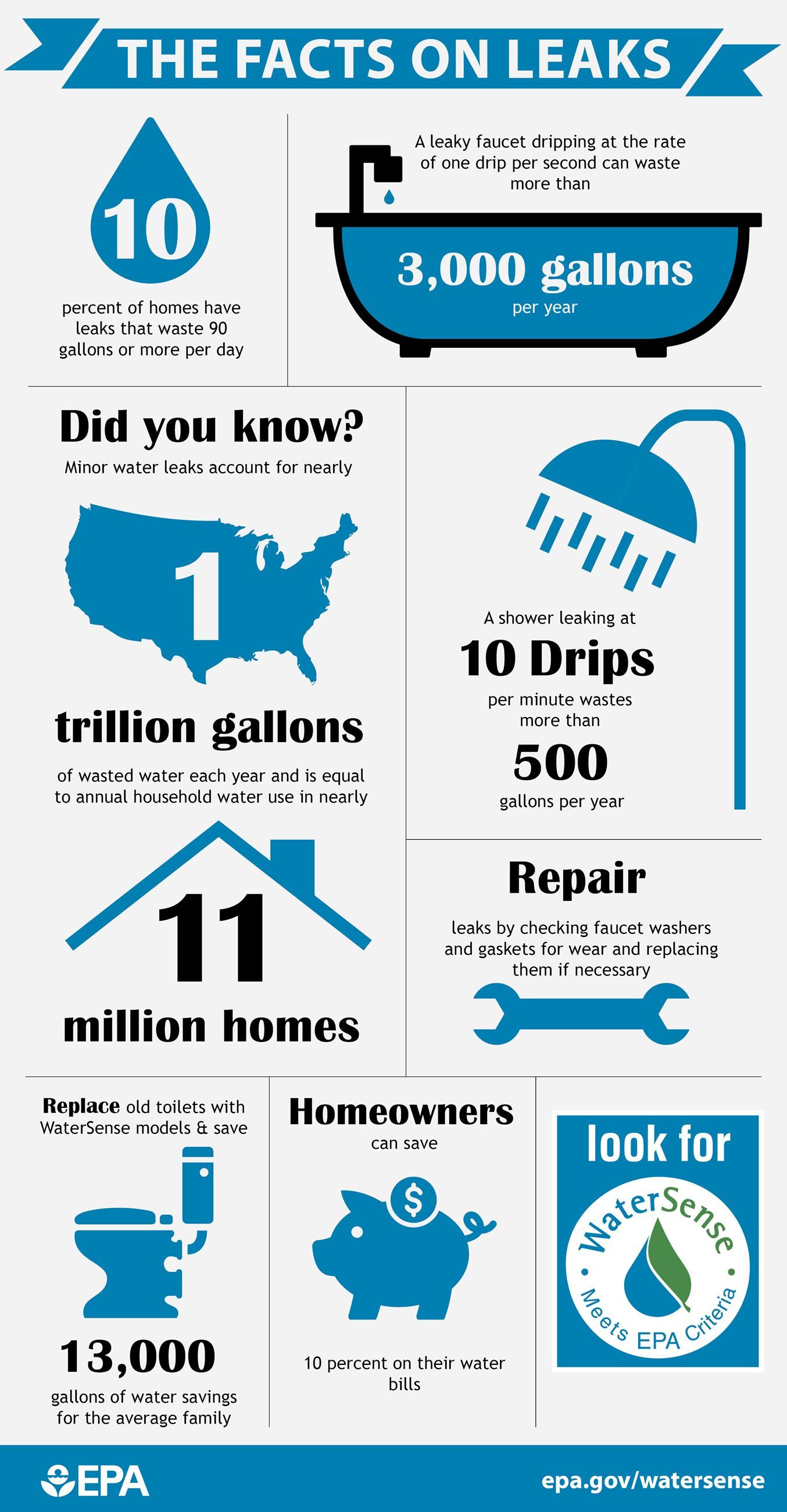

- Sudden increases in water bills, suggesting possible hidden leaks

- Stains on floors or carpets, which could indicate water seepage

Some water leaks, like a dripping faucet or a leaking water heater, are easy to see. Others may be hidden behind walls or under floors.

Regular checks of water meters, plumbing fixtures, and roofs can help find problems before they become big issues.

When leaks happen, it is important to fix them quickly. This helps prevent problems like mold growth or damage to a tenant's property. Prevent water damage by responding immediately and taking action to stop the leak at its source.

How Property Managers Respond to Water Leaks

When a leak is detected in a rental property, a property manager plays a vital role in

coordinating the repair process and protecting both the property and the tenant's interests. Here's how they typically manage the situation:

1. Shutting Off the Water & Assessing the Damage

The first step a property manager takes getting the water turned off and assessing the extent of the water damage. Whether it's from a burst pipe, a malfunctioning water heater, or external water intrusion, it's essential to document the situation thoroughly. This includes checking for signs of water in adjacent units and areas of the building, as well as determining if the leak is contained or still active.

2. Hiring Professional Vendors

Next, the property manager will work with trusted vendors to fix the issue. These professionals are often called upon for water damage restoration, leak detection, and plumbing repairs. The goal is to repair the leak quickly and address any affected areas, such as damaged drywall, carpets, or flooring.

In severe cases, such as leaks caused by natural disasters or long-term neglect, it may be necessary to work with mold remediation experts to restore the property and ensure the safety of tenants.

3. Managing Repairs and Restorations

After the initial repairs, the property manager coordinates any

water damage restoration needed to return the unit to its pre-damage condition.

This could include:

- Replacing damaged drywall

- Fixing structural elements compromised by the leak

- Drying out and replacing wet flooring or carpets

- Ensuring the structural integrity of the property is maintained

4. Communicating with Tenants and Property Owners

Throughout the process, maintaining

clear and open communication is key. Tenants need to know when repairs will take place and what steps are being taken to minimize disruption. Property owners are kept informed about the cost and scope of the repairs and any actions needed to prevent future leaks.

In addition, property owners may need to file a claim with their insurance company to cover the costs of the repairs, especially if the damage is extensive. A good property manager can assist by providing documentation and facilitating communication between the owner and the insurance company.

The Importance of Preventative Measures

While it’s essential to respond quickly to leaks, preventative measures can save property owners from the headache of emergency repairs and extensive damage.

Regular inspections of plumbing systems, roofs, and gutters can help spot potential issues before they turn into significant problems.

Here are some preventative measures that every property manager should implement:

- Inspect water heaters regularly:

A faulty water heater can lead to leaks or even catastrophic flooding if it bursts. Routine checks help identify issues early.

- Monitor water usage: Keeping an eye on the building’s water meters can indicate potential leaks. A sudden spike in water usage without an apparent cause could suggest a hidden leak that needs investigation.

- Schedule roof inspections:

Water leaks from the roof can cause significant damage if not caught early. Regular roof inspections, especially after storms, are essential for maintaining the property’s structural integrity.

- Check for signs of aging pipes: Pipes, especially in older buildings, can deteriorate over time, leading to burst pipes and leaks. Replacing old or corroded pipes proactively can prevent larger problems.

Handling Different Types of Water Damage

Not all water leaks are the same, and different types of water damage require specific responses.

Property managers are equipped to handle:

- Clean water leaks, such as those from a broken water supply line, which require immediate repair and drying of the area.

- Gray water leaks, which come from appliances like washing machines or dishwashers, may require additional sanitation measures.

- Black water leaks, such as sewage backups, require professional cleanup and significant restoration due to health risks.

Understanding the nature of the leak helps the property manager take the right steps to prevent water damage from spreading and ensure the safety of tenants.

Filing Insurance Claims for Water Damage

For property owners, dealing with the financial impact of water leaks can be daunting. In cases of extensive property damage, it’s often necessary to

file a claim with the insurance company. A seasoned property manager can assist in this process by providing documentation of the damage, repair estimates, and reports from the vendors involved in the water damage restoration process.

Having a property manager that understands how to navigate these claims can expedite the process and ensure you receive the compensation needed to cover repairs and restore the property to its original condition.

Download a free copy of our Water Leak Checklist

Final Thoughts: Protect Your Property from Water Leaks

At Coastline Equity, we understand the importance of managing water leaks swiftly and effectively. Whether it’s a minor drip or a major burst pipe, our team takes immediate action to prevent further property damage, protect tenants’ property, and maintain the value of your rental property. By implementing preventative measures and conducting regular inspections, we help property owners stay ahead of potential issues and avoid costly repairs.

If you’re a property owner or tenant dealing with a water leak or simply want to learn more about how to prevent water damage,

contact Coastline Equity today. We’re here to help you protect your investment and ensure your tenants feel safe and secure in their homes.

Common Questions About Water Leaks and Property Management

Q: How do I know if there is a hidden water leak in my rental property?

A: Keep an eye on your water meters for unexplained spikes in usage. Look for visible signs of water damage, such as stains on ceilings or damp spots on floors and walls. Regular inspections can also help catch leaks before they become serious.

Q: What should I do if my water heater leaks?

A: Report the leak to your property manager immediately. Water heaters can cause significant flooding if not dealt with promptly. Your property manager will coordinate repairs and may recommend replacing the unit if needed.

Q: How do I file a claim for water damage?

A: If you experience significant property damage from a leak, your property manager can help you document the damage and file a claim with your insurance company. They will work with vendors to provide repair estimates and assist throughout the process.

Q: What types of water damage are the most serious?

A: Black water damage, such as sewage backups, poses health risks and requires immediate professional attention. Gray water leaks from appliances also need to be addressed quickly to prevent contamination, while clean water leaks are less dangerous but can still cause structural damage if not resolved quickly.

Q: What should I do if I notice a leak in my rental property?

A: Immediately report the leak to your property manager. Early detection prevents further damage and minimizes repair costs.