Understanding Property Tax Rates, Exemptions, and Impacts on Investors

California Property Taxes, what you need to know

When it comes to owning property in California, understanding property tax is essential for every homeowner and real estate investor.

California property tax is primarily based on the assessed value of your property. This value is usually determined when you purchase the home. This tax can have a significant impact on your overall expenses, so it’s crucial to know how it’s calculated and what exemptions might apply to you.

Taxes in California are unique, with regulations that can change based on state laws and local policies.

Familiarizing yourself with these rules can help you manage your finances better and take control of your property ownership responsibilities. Knowing how to navigate the system, including options for appealing assessments, can save you money in the long run.

As a property owner, keeping track of your assessed value is important. This value directly influences the amount you pay in property taxes each year. Understanding this process not only helps in budgeting but also empowers you to make informed decisions about your investment.

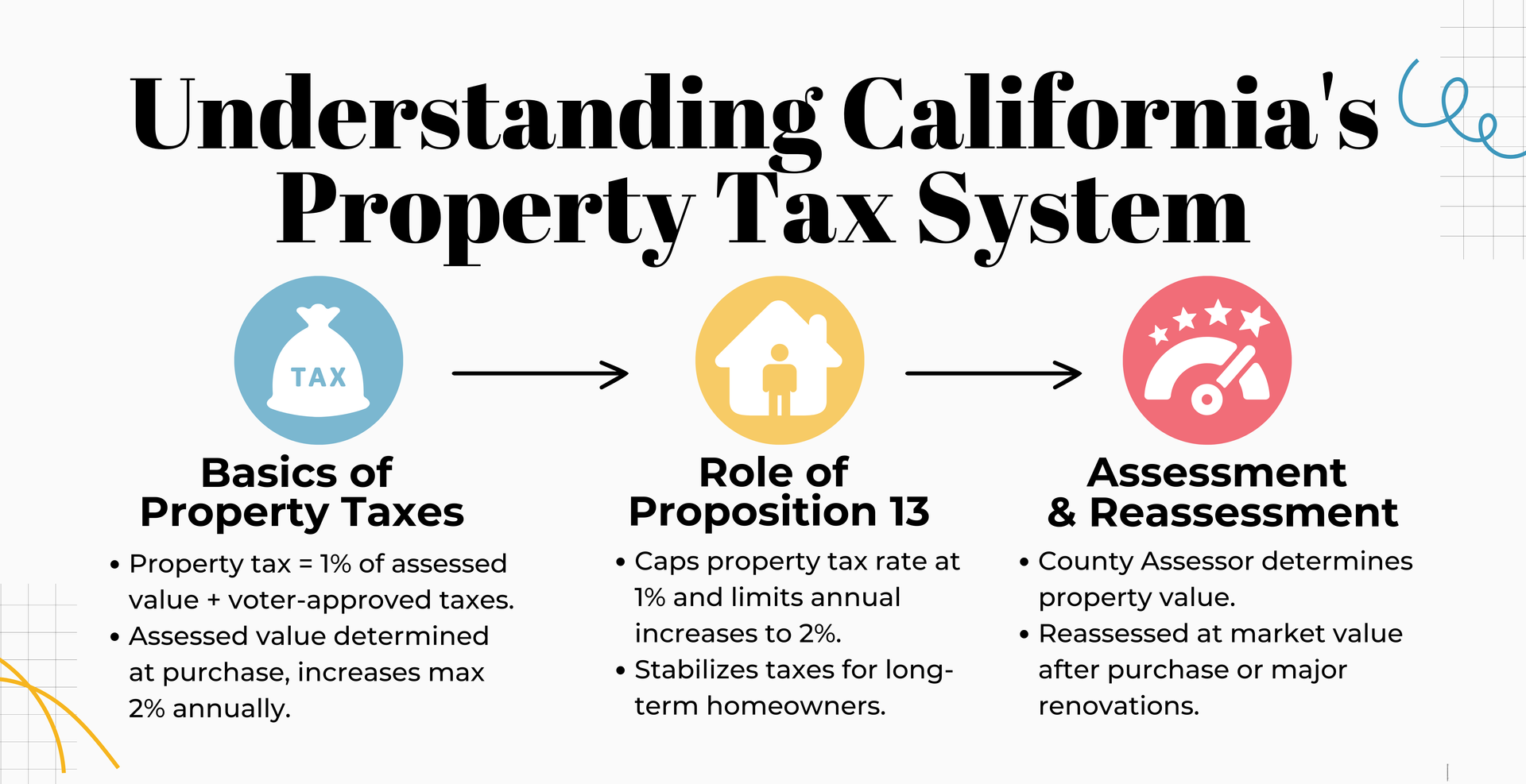

Understanding California's Property Tax System

California's property tax system has unique features that influence how taxes are levied and paid. Understanding the basics, the impact of Proposition 13, and the assessment processes is essential for property owners.

Basics of Property Taxes

Property taxes in California are primarily based on the assessed value of your property. The standard property tax rate is 1% of the assessed value, plus any additional voter-approved taxes.

Note: Property tax rates can vary by city and even neighborhood due to special assessments and additional fees. Check with your county assessor’s office for the most precise tax obligations.

Your property's assessed value is determined when you buy it. This value can increase by a maximum of 2% each year, unless there is a major renovation or a change in ownership.

Local governments use property tax revenue to fund essential services like schools, police, and infrastructure. In 2010-11, property taxes generated over $55 billion in revenue for local governments.

Role of Proposition 13

Proposition 13, approved in 1978, transformed California's property tax system. It capped property tax rates at 1% of assessed value and limited annual increases to 2%, regardless of market fluctuations.

This law significantly benefits homeowners by stabilizing tax bills. However, it also means that newer homeowners may pay much higher taxes on their properties compared to long-term owners.

While Proposition 13 has its advantages, it can create inequities in funding for public services. The varying assessed values can lead to challenges in how much revenue local governments receive.

How Proposition 13 Affects Two Property Owners

Property Owner A – Long-Term Owner (Purchased in 1995)

- Bought their home in Los Angeles for $250,000 in 1995.

- Initial property tax: $2,500 per year (1% of assessed value).

- Due to Proposition 13, their assessed value increases only 2% per year, so in 2025, their taxable assessed value is about $415,000.

- Current annual property tax (2025): $4,150 per year (1% of assessed value).

Property Owner B – Recent Buyer (Purchased in 2025)

- Buys the same house in 2025 for $1,000,000 (market value).

- Their property is assessed at full market value, meaning they immediately pay $10,000 per year in property taxes (1% of assessed value).

- Their tax bill is more than double what Property Owner A pays for the exact same home.

Key Takeaway:

Proposition 13 keeps long-term property owners' tax bills low, but newer buyers face significantly higher taxes since their property is assessed at the latest market value. This creates a tax disparity between older and newer property owners.

Assessment and Reassessment Processes

Assessments are critical in determining how much property tax you owe. The County Assessor in your area is responsible for assessing properties.

When you purchase a property, it is reassessed at market value. If your home undergoes significant renovations, it may also be reassessed.

If you believe your property is overvalued, you can appeal the assessment. The appeal process involves certain steps, including filing with the local assessment appeals board, which can help adjust your tax if warranted. This means staying proactive about your assessments and understanding your rights as a property owner.

Calculating Your Property Tax Bill

Understanding how to calculate your property tax bill is essential for effective financial planning. This involves knowing the assessed value of your property, applying the appropriate tax rate, and considering any additional charges or fees that may apply.

Determining Assessed Value

The assessed value of your property is a critical starting point. In California, this value is typically based on the purchase price of your home, along with adjustments for inflation. County assessors determine this value during regular assessments.

You can find your property’s assessed value on your property tax bill or by checking your county's property tax records. Keep in mind that if your home has been renovated or if property values in your area have increased, this may affect your assessed value.

Understanding this number helps you gauge your potential tax obligations.

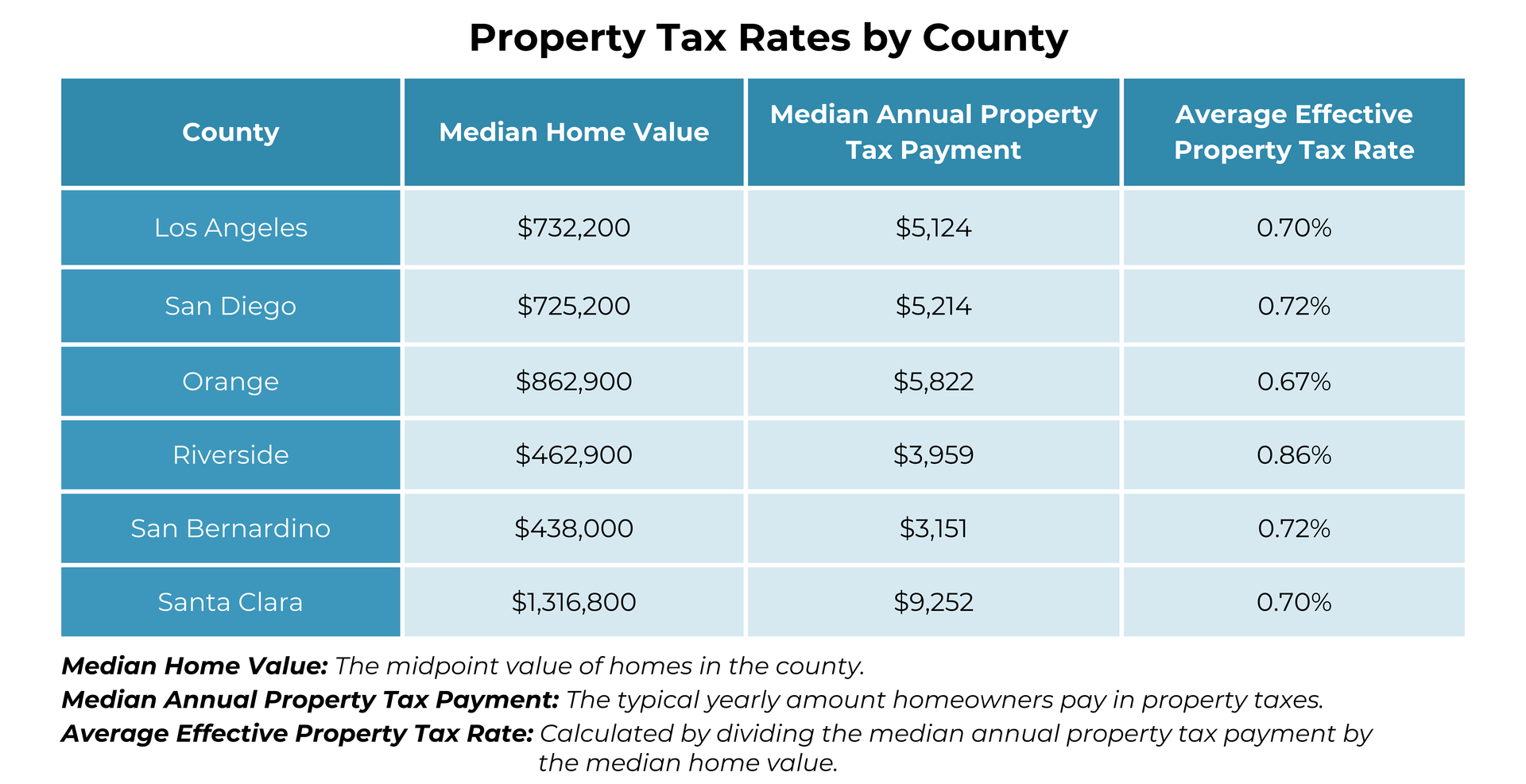

Applying the Tax Rate

Once you know the assessed value, the next step is applying the tax rate. In California, the average property tax rate is around 1% of the assessed value, though this can vary by county.

To calculate your property tax bill, multiply the assessed value by the tax rate. For example, if your home is assessed at $200,000, your base property tax would be $2,000.

It's important to check if your local jurisdiction has additional tax assessments or parcel taxes that may raise your total obligation.

Additional Charges and Fees

In addition to property taxes, you may encounter various charges and fees. These can include assessments for local services and maintenance, often referred to as parcel taxes.

Parcel taxes are special taxes used to fund specific projects or services. They are usually based on the number of parcels rather than property value. Be sure to review your property tax statement carefully, as these additional fees can significantly impact your overall tax bill.

Property Tax Exemptions and Reductions

California offers several property tax exemptions and reductions that can significantly lower your tax bill. Understanding these options is key to taking advantage of potential savings.

Homestead Exemption

The Homestead Exemption allows you to reduce the taxable value of your primary residence by $7,000. This exemption applies only to owner-occupied homes. To qualify, you must file a one-time application with your local county assessor.

This reduction means you save about $70 annually, as property tax rates in California are generally around 1% of assessed value. It’s important to ensure your property was your primary residence on January 1 of the tax year to be eligible.

Senior Citizen and Disabled Exemptions

If you are 55 or older, or severely disabled, California provides additional exemptions to ease your tax burden. These exemptions include a senior citizen property tax postponement program, allowing you to defer payment of property taxes on your primary residence.

To qualify for the disabled veterans exemption, homeowners must meet specific income and disability requirements. Reductions can significantly lower your property tax, helping you manage your finances better during retirement or while coping with disabilities.

Disaster Relief

California offers disaster relief for property owners affected by natural disasters like wildfires or floods. If your home has been damaged or destroyed, you may qualify for a temporary reduction in property taxes.

Property owners must file claims within a short period following the disaster. This relief helps lessen the financial impact of unforeseen events, allowing you to rebuild without additional tax burdens.

Payments and Penalties

You need to understand how to pay your property taxes and the penalties for late payment. It's also important to know how to appeal your tax assessment if necessary. This section covers important details about these processes.

Paying Your Property Tax Bill

When you receive your tax bill, you have several options for payment. You can pay your property taxes online through your local taxing agency's website, by mail, or in person at the county office. In Los Angeles County, for instance, the due dates are December 10 for the first installment and April 10 for the second installment.

If you choose online payment, check if there are any processing fees. You may also set up a payment plan if you're unable to pay the full amount at once. It's crucial to pay on time to avoid penalties and interest.

Consequences of Non-Payment

Failing to pay your property taxes can lead to serious consequences. If taxes remain unpaid, your property can become tax-defaulted. This typically occurs if payments are overdue for five years. In this case, the county can sell your property to recover the unpaid taxes.

Penalties for late payment can vary. For example, a late payment might incur a 10% penalty for the first installment and eventually grow with additional fees for each missed payment. To avoid these harsh penalties, stay on top of your tax obligations.

Appealing Your Tax Assessment

If you believe your property tax assessment is too high, you have the right to appeal. Start by gathering evidence. This can include recent sales of comparable homes in your area or an independent appraisal.

You must file your appeal within a designated time frame after you receive your tax bill. In Los Angeles County, the deadline is typically around 60 days after your tax bill is mailed.

During the review process, the taxing agency will evaluate your evidence. They will determine if your assessment should be adjusted. Be ready to present your case clearly and concisely.

Let's elevate the industry together—share this blog with fellow investors.

More about Coastline Equity

Property Management Services

Learn More

Learn MoreOur team will handle all your property needs, offering specialized services such as in-depth inspections, liability management, staff recruitment and training, and round-the-clock maintenance—expert support tailored to the unique requirements of your real estate assets.

About Us

Learn More

Learn MoreOur dedicated team transforms property management challenges into opportunities. From tenant management to streamlined rent collection and proactive maintenance.

Property Management Excellence

Learn More

Learn MoreAs a contributing author for Forbes, Anthony A. Luna brings a wealth of expertise and knowledge in the property management industry, real estate sector, and entrepreneurship, providing insights and thought-provoking analysis on a range of topics including property management, industry innovation, and leadership.

Anthony has established himself as a leading voice in the business community. Through his contributions to Forbes, Anthony is set to publish his first book, "Property Management Excellence" in April 2025 with Forbes Books.

Insights

Learn More

Learn MoreLearn more about Coastline Equity's property management practices & processes and how we support our clients with education and a growth mindset.

Coastline Equity Property Management is your partner as you continue to learn and grow.

News & Updates

Property Management Made Easy

Los Angeles

1411 W. 190th St.,

Suite 225

Los Angeles, CA 90248

Temecula

41743 Enterprise Circle N.,

Suite 207

Temecula, CA 92590