What is a Cap Rate? A Key Metric for Real Estate Investors

Calculating Cap Rates: A Step-by-Step Guide

When it comes to evaluating real estate investments, one of the most crucial metrics to understand is the capitalization rate, commonly known as the Cap Rate. This key figure helps investors assess the potential return on investment (ROI) from a property, guiding critical decisions in both commercial and rental real estate markets. But what exactly is a Cap Rate, and how does it influence investment choices?

Understanding Cap Rate

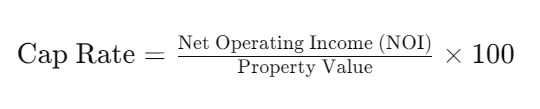

At its core, the Cap Rate is a simple yet powerful formula used to determine the rate of return on a real estate investment based on the net operating income (NOI) the property generates. The formula is straightforward:

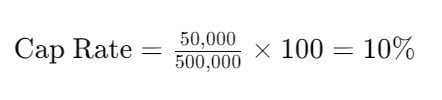

Net Operating Income (NOI) is calculated by subtracting all operating expenses (such as maintenance, insurance, and property taxes) from the gross income the property generates. For instance, if a property has an NOI of $50,000 and is valued at $500,000, the Cap Rate would be:

This 10% Cap Rate indicates that the property is expected to generate a 10% return on its value annually, making it a valuable tool for comparing investment opportunities.

Why Cap Rate Matters

Cap Rate plays a pivotal role in evaluating the profitability of an investment property. It provides investors with a quick snapshot of the expected return, helping them compare properties and make informed decisions. A higher Cap Rate typically suggests a higher potential return but may also indicate higher risk, particularly in less stable or emerging markets.

For instance, a property in a booming commercial area might have a lower Cap Rate due to its perceived stability and lower risk, while a property in a less desirable area might offer a higher Cap Rate to attract investors willing to take on more risk.

Factors Influencing Cap Rate

Several factors can influence a property’s Cap Rate:

- Location: Properties in prime locations usually have lower Cap Rates due to higher demand and lower risk.

- Market Conditions: Economic downturns or booms can significantly impact property values and, consequently, Cap Rates.

- Property-Specific Factors: The condition of the property, its income-generating potential, and its operating expenses (including property taxes) all play a role in determining the Cap Rate.

- Interest Rates: Fluctuations in interest rates can affect the overall investment environment, influencing Cap Rates.

Interpreting Cap Rate

A common question among investors is, "What constitutes a good Cap Rate?" The answer varies depending on the type of property and the investor’s risk tolerance. Generally:

- Higher Cap Rates (e.g., 8-12%) may indicate higher risk but also higher potential returns.

- Lower Cap Rates (e.g., 4-6%) often suggest lower risk and are common in stable, high-demand areas.

Investors use the Cap Rate not only to assess potential returns but also to gauge the risk associated with an investment. For example, while a higher Cap Rate might seem attractive, it’s important to consider whether the potential reward justifies the accompanying risk.

Cap Rate and Property Types

The Cap Rate can vary significantly depending on the type of property:

- Commercial Properties: Often have lower Cap Rates due to their stable, long-term leases.

- Rental Properties: May exhibit higher Cap Rates, especially in markets with fluctuating rental demand.

- Investment Properties: Investors typically seek properties with a balance of good Cap Rate and stable income to maximize their ROI.

Cap Rate vs. Other Investment Metrics

While the Cap Rate is a valuable metric, it’s not the only one investors should consider. Other important metrics include:

- Rate of Return: Measures the overall profitability of an investment.

- Gross Income: While Cap Rate considers NOI, gross income is also a critical factor in evaluating a property’s potential.

- Adjusted Gross Income: A refined measure that accounts for additional expenses.

- Capital Gains: The increase in property value over time can impact the overall return, beyond what the Cap Rate alone can indicate.

Calculating Cap Rates: A Step-by-Step Guide

To calculate a Cap Rate, follow these steps:

- Determine the Property’s NOI: Subtract all operating expenses (including property taxes) from the gross income.

- Find the Property’s Market Value: This could be the purchase price or the current market valuation.

- Apply the Cap Rate Formula: Divide the NOI by the property value and multiply by 100 to get the percentage.

For example, if a rental property generates $80,000 in gross income, with operating expenses of $20,000, and is valued at $1,000,000, the NOI would be $60,000, leading to a Cap Rate of 6%.

Common Misconceptions About Cap Rate

Despite its simplicity, several misconceptions surround Cap Rate:

- Cap Rate Alone is Sufficient: While important, Cap Rate should be considered alongside other metrics like ROI and capital gains.

- Cap Rate Reflects Market Value: It’s a measure of return, not an indicator of market value.

- Cap Rates are Static: They can change with market conditions, so regular reassessment is essential.

FAQs: Quick Answers to Common Questions

- What is a Cap Rate in simple terms? Cap Rate is the percentage of return expected on a real estate investment, based on the property’s NOI.

- How does gross income affect Cap Rate? Gross income is the starting point for calculating NOI, which directly influences the Cap Rate.

- Can Cap Rate be negative? A negative Cap Rate indicates that a property’s operating expenses exceed its income, which is a red flag for investors.

- What is the difference between Cap Rate and ROI? Cap Rate measures return based on NOI and property value, while ROI considers the overall profitability, including capital gains.

- Is a higher Cap Rate better? Not necessarily; a higher Cap Rate may indicate higher risk. It’s crucial to consider the broader context.

Let's elevate the industry together—share this blog with fellow investors.

More about Coastline Equity

Property Management Services

Learn More

Learn MoreOur team will handle all your property needs, offering specialized services such as in-depth inspections, liability management, staff recruitment and training, and round-the-clock maintenance—expert support tailored to the unique requirements of your real estate assets.

About Us

Learn More

Learn MoreOur dedicated team transforms property management challenges into opportunities. From tenant management to streamlined rent collection and proactive maintenance.

Property Management Excellence

Learn More

Learn MoreAs a contributing author for Forbes, Anthony A. Luna brings a wealth of expertise and knowledge in the property management industry, real estate sector, and entrepreneurship, providing insights and thought-provoking analysis on a range of topics including property management, industry innovation, and leadership.

Anthony has established himself as a leading voice in the business community. Through his contributions to Forbes, Anthony is set to publish his first book, "Property Management Excellence" in April 2025 with Forbes Books.

Insights

Learn More

Learn MoreLearn more about Coastline Equity's property management practices & processes and how we support our clients with education and a growth mindset.

Coastline Equity Property Management is your partner as you continue to learn and grow.

News & Updates

Property Management Made Easy

Los Angeles

1411 W. 190th St.,

Suite 225

Los Angeles, CA 90248

Temecula

41743 Enterprise Circle N.,

Suite 207

Temecula, CA 92590